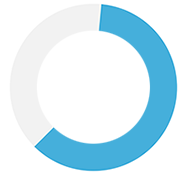

Of employees worry about their financial future and stay awake at night stressing out about money.

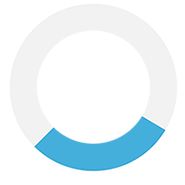

Of HR professionals say financial stress is having some impact on employee work performance

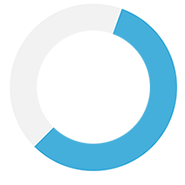

Say that personal finances distract them at work.

A clear majority of employers say that they believe that financial education boosts productivity

Scientifically designed by Financial Experts based on indepth research, to assess the overall Financial stress levels of the employees of a company. Provides a comprehensive report with suggested action plan for the company to improve the financial wellness of the employees.

Improving financial literacy is the first step towards financial wellness and financial discipline. Through our digital learning platform your employees will be administered financial education covering topics like budgeting, managing loans, planning their investments, goal planning, retirement planning, tax planning and estate planning.

If your employees have any specific financial issues, they can talk to our Financial Counsellors who can guide them on how to resolve the issues. The financial counselling is provided for a specific issue and it’s not general in nature.

PrognoAdvisor’s digital financial planning platform has a sophisticated financial model integrating cash flow and goal planning to deliver the most practical financial plan, covering all aspects of a person’s finances like managing income & expenses, loans, planning goals, investments, insurance, savings, taxes and succession.

Self-help Calculators and planning tools for employees to put into practice managing their newly acquired knowledge on managing money. These include budget planner, life insurance planner, retirement calculator, investment portfolio tracker, debt manager, life insurance calculator, tax calculator, tax planner and tax filing.

A portal for the employees to access various services mentioned above. The portal can be integrated with the HR portal of the company to have a seamless experience.