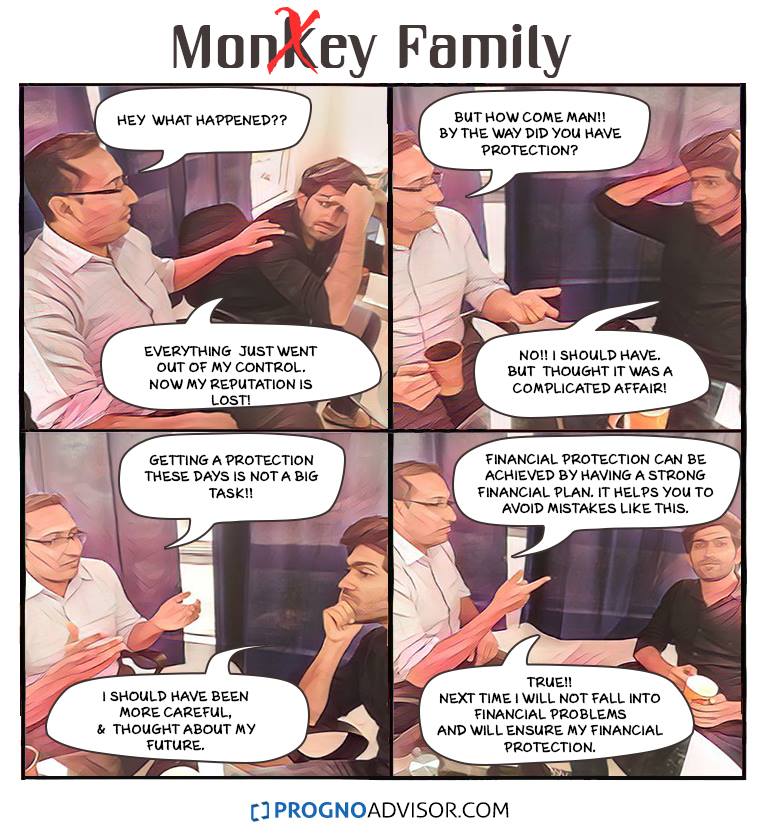

Money Family #2 - Avoiding costly mistakes

Making mistakes is human nature. But when they’re financial follies and cost you hard-earned cash, they become particularly painful. Uninformed decisions, when it comes to investing or trading stocks, can make you lose a large chunk of your money, and even tarnish your reputation.

Having an experienced person to guide you in managing your financials is extremely important when you are handling large sums of money. Even if you don’t have the provision to get such guidance, every person must have a solid budget and plan to spend, save and invest money. Have a basic knowledge about various investment options, tax returns and other financial affairs.

These days, with internet and computer/smartphone being common in every household, getting financial education and advice becomes much easier. There are tools and websites that help you to keep a check on your cash-flow, easily create a budget and track your savings. You can check our free financial diagnosis to undergo an analysis about your current financial status and receive suggestions to improve.

Be careful before making any big financial decisions. While making errors can be unavoidable, costly errors can be avoided with proper guidance. Most of the important goals and milestones in our lives are defined by our financial situations. So it is better to be safe than sorry.

Post Your Comments