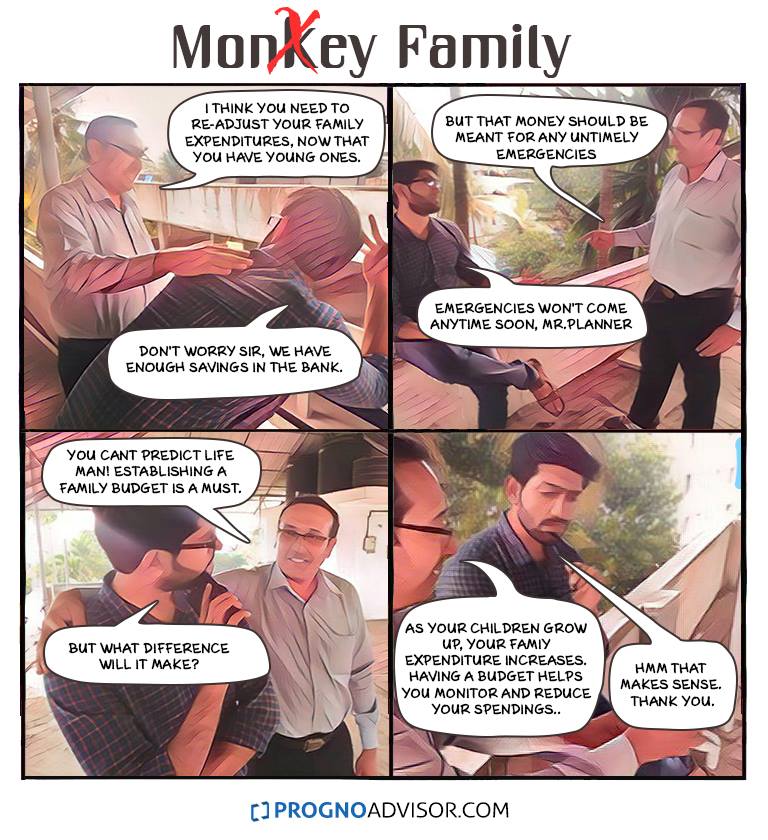

Money Family #3 - Importance of family budget

When we live as a family, either we depend on our family members, or we have people depending on us. As most conflicts within families arise due to improper money distribution, it is important that families monitor their spending habits through a family budget. A family budget is a statement which shows how family income is spent on various items of expenditure on necessities, comforts and luxuries.

Like the character in this cartoon, it is easy to assume that you will be able to afford all the luxuries in life, as long as you have savings in the bank. The problem arrives only when some unexpected emergency hits, and you’ll have to struggle to find money for the bills.

Not many families in India have a habit of setting up a family budget. In a family where there is more than one earning member, this becomes particularly important, as this helps to provide an account for every penny spent, thus reducing the arguments related to finance. Through budgeting, family members learn to spend money wisely, thus saving money which could be used for other family needs.

4 easy steps to create a family budget:

1. Create a list of the monthly income of the family (total income of all earning members).

2. At the beginning of a month, create a list of the amount you plan to spend (planned expense). At the end of the month, find out how much you have actually spent (actual expense). This shows you how much more you have spent than planned. Try to reduce the difference.

3. Always set aside a fixed amount of money as savings for emergencies. Ideally, at any point, you should have savings equivalent to 6 months of your salary kept aside for untimely emergencies.

4. Develop this as a habit and follow it in a disciplined manner.

Post Your Comments