How to improve your credit score in India

How to improve your credit score in India

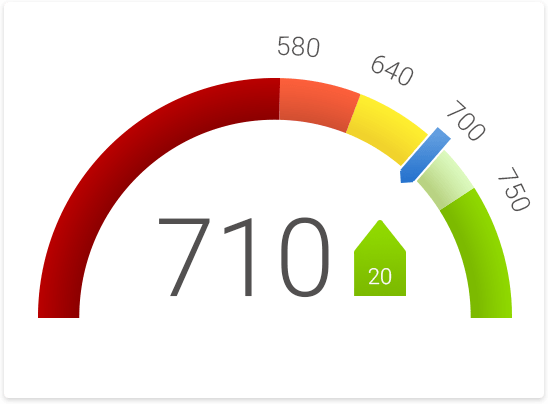

Your credit score is one of the most important numbers of your life.A credit score sums up your credit risk, or it represents how reliable a borrower you are. (For example, the likelihood you’ll pay your bills on time). It is more than just a number. It represents your creditworthiness, how well (or poorly) you manage your debt.

A good credit score ranges from 800-850. If you

have a score of 800 and above, banks and other NBFC’s consider you to be credit

healthy. But if you have a score less than 800, banks feel it is as a risk to

provide you a loan or credit card. Banks and other

NBFC’s are comfortable with approving loans to customers who have a score of 800

and above.There is a hard fact that 75% of loan and credit application are

with held due to poor credit record of the applicant.

There are 4 credit bureaus in India

which are authorized by RBI. You can choose to get your credit score online

from the websites of any of the bureaus. Equifax India, High Mark Credit

Information Services Pvt.Ltd and Experian, along with CIBIL are the four

credit bureaus in operation in India There are also a few reputed credit

management companies which help you understand your credit health and

provide online analysis.

Benefits of having a good credit

score

·

Having good credit is

important because it determines whether you’ll qualify for a loan.

·

Maintaining a balance between secured and unsecured

loans.

·

A good credit score gives you leverages to

negotiate a lower interest rate on your credit card or a new loan.

·

Ensuring your debt-to-income ratio is low.

· No (or low) Security Deposits, as utility companies

and other service providers are happy to offer their services to customers who

have a history of paying bills on time.

Conclusion

There are various factors that affect the credit score, which

includes, Payment history, total amount owed,

length of credit history, types of credit, new credit etc. When

information is updated on a borrower’s credit report, his or her credit score

changes and can rise or fall based on the new information.Thus paying your bills on time and in full consistently will help you prevent

damaging your credit score.

It can be considered as a value expressing your

creditworthiness.

Post Your Comments